As mentioned in my previous post I’ve been working with Justine Pollard to deconstruct her trading methods. Now, as I started to dig a little deeper, I discovered something I’ve never seen before… an unmatched level of transparency!

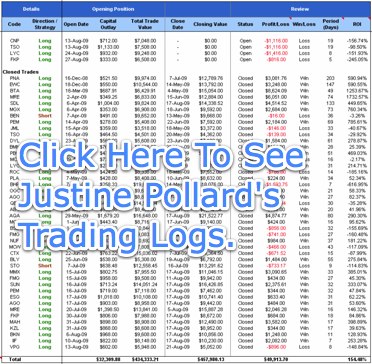

Here’s just a few of her verified results.

2007 – CMC Markets 2007 Trading Comp – 82% return in 8 weeks

2008 – CFD Trading diary – 300% in 6 weeks

2009 – Teleconference series – 262% in 4 months

Here’s the proof…

Between June – Sept 2009, Justine shared all her trades as part of a 4 month teleconference program for her top coaching clients. Now for the first time, outside of her club, she shares the details as part of the Online Trading Mastermind.

Click here to download her complete logs and mp3s talking through her trading. The insight you will gain will be well worth it. I’d love to hear what you think.

Your Trading Coach,

David Jenyns

Ps. Click the link below to see Justine’s CFD Trading logs.

Greetings from CANADA David,

And Now For Something Completely Different….. (Yeah we share that

heritage)

First off, my thanks to you for all your assistance – some free, some paid

for.

Truth be told we both know it’s far easier to make money Telling people how

to make money, than it is to actually Make money.

BUT as far as that goes, your advice is most assuredly in the value added

category, and I Commend and Thank You.

Reading your latest email I came across a quote I just couldn’t let go.

“There is a saying “When the student is ready, the teacher will appear.”

But the Primary Aim of your efforts and Real Quote, must ultimately be –

“There is a saying “When the student is ready, the teacher will disappear.”

And that, my friend, is the place I find myself at the moment.

To explain: Please allow me a moment to share the current wisdom of my ten

year journey as a retail investor. In order of importance.

1) Buy and Hold truly is “Investing For Dummies”

2) All Fundamental Analysis is pretty much a waste of time – period. It

describes – in the long run – what a company should be worth between now and

then. Apart from the lies and misdirection, the important point is that a

lot of stuff can happen between now and then. To keep things current, just

ask British Petroleum. And to keep things Australian, how about Nassim

Taleb’s “The Black Swan” as the final word on this point.

INTERMISSION: All smiles so far, but….

3) LOTS of time can be pissed away – Canadians like beer as much as

Australians- by Over Complicating technical analysis. As much as we all

deny it, we All of us can’t help but search for the Holy Grail (Do you think

a swallow could fly all the way from Canada to Australia carrying a pint of

Alexander Keith’s India Pale Ale? If I thought it could I’d strap one on and

send it to you straight away – yes I’m from Nova Scotia- New Scotland, Brits

weren’t too keen on that crowd either as I understand, and this point is

totally irrelevant, but I feel I owe ya…)

4) Any REASONABLE technical analysis system will, in the long run,

outperform your average financial planner by a significant margin. And to

elucidate what reasonable means – Asked to pick one of the following as your

Only TA window on the markets, what would you pick. MACD or ADX? This is in

part why it takes a while to progress – the sheer volume of TA

gems/nonsense.

And now for the Finale…

5) Select the TA method that resonates with you. THEN MOST IMPORTANTLY.

Realize that your method is akin to a baby’s blanket or a cherished Baby

Bear (OK hang on, for the all the Longs make that a cherished Baby Bull).

The absolute most important aspect of trading is Risk Control. Spend more

time on developing a Risk Control strategy than you do a TA strategy.

6) Don’t bounce all around trying to over-optimize a system (or myriad of

systems). Really Study the chosen system and how it reacts to different

markets – become the best friends, get to know each other well.

7) Read number 5 and 6 again….

This has been my strategy for survival. And I’ve seen enough. I started my

investing career at the Peak of the Tech Boom, the heady days of the COMPQ

at the turn of the century. Only to watch the lemmings jump off a cliff. I’m

not overly rich, but I’m still here – as primitive as my risk control ideas

were at the time, they were my salvation.

Once again David – thank-you for your help (Then and Now) on my journey.

Cheers,

Larry

PS. My latest TA effort is centered on simplicity, yet complicated. Three

separate mechanical systems, each with the constraint of two, at most, TA

indicators, with the demand that each system, on a stand-alone basis, must

be considerably more profitable than buy and hold. The 3 variables are what

the market offers – Price, Volume, Market Breadth (Yes this is an

Index/Sector based ETF system) – Speaking of risk control why not eliminate

Company specific risk, now just Market and/or Sector risk to worry about.

Then each system is assessed for strengths and weaknesses in each of the

three market conditions: Up, Down, Flat. And all will finally be combined in

a synergistic manner such that the whole is greater than the sum of the

parts. This mechanical system will be then be integrated with a

discretionary pattern based system into a “MetaSystem” :). And the last word

… speaking of pattern based systems, I strongly believe that a Hard

Working technical analyst with simple tools and using a combination of eyes

and brain can still, for the moment at least, outperform any computer based

system currently affordable to the retail and mid level institutional

investor.